What is Private Mortgage Insurance?

Private Mortgage Insurance, better known as PMI, is an added cost many homebuyers encounter when they purchase a home with less than a 20% down payment. PMI is not homeowner’s insurance—it doesn’t protect your house or belongings. Instead, PMI protects the lender in case the borrower defaults on the loan.

While PMI may sound like just another fee, it often plays an important role in helping buyers achieve homeownership sooner. Rather than waiting years to save up a full 20% down payment, PMI makes it possible for buyers to purchase with as little as 3–5% down. The tradeoff is an added monthly premium until certain conditions are met.

For anyone considering a mortgage, especially first-time buyers, understanding PMI is essential to making informed decisions about costs, loan options, and long-term savings.

Why Lenders Require PMI

Lenders view loans with small down payments as higher risk. If a borrower stops making payments and the lender must foreclose, the lender may not recover the full loan balance after selling the property. PMI reduces this risk by insuring the lender against potential loss.

For example, if you buy a $300,000 home with 5% down ($15,000), your mortgage is $285,000. If the lender has to foreclose and the home only sells for $260,000, PMI helps cover that shortfall. While this insurance protects the lender, the borrower pays for it.

From the lender’s perspective, PMI makes low-down-payment loans feasible. From the borrower’s perspective, it can be the bridge to homeownership without waiting to save a large lump sum.

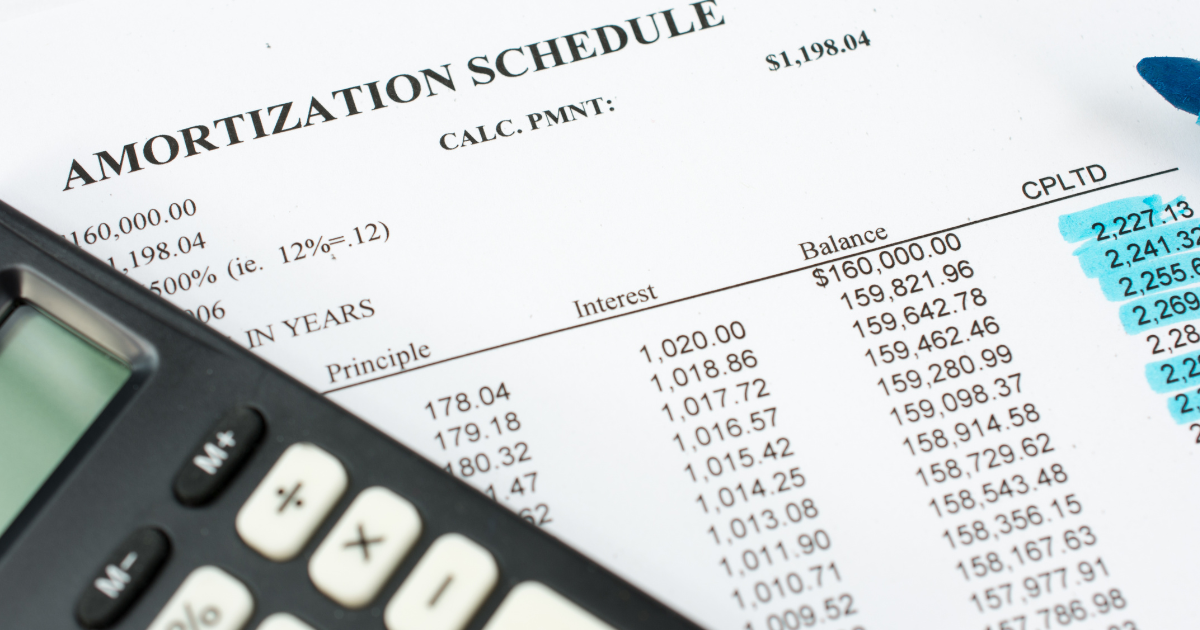

How PMI is Calculated

The cost of PMI varies based on several factors:

- Loan-to-Value Ratio (LTV): The closer you are to 20% equity, the lower the PMI rate.

- Credit Score: Higher credit scores usually translate to lower PMI premiums.

- Loan Type: Conventional loans handle PMI differently than FHA or VA loans.

- Coverage Required: Some lenders require more coverage depending on the risk profile.

Typically, PMI ranges from 0.2% to 2% of the original loan amount annually, divided into monthly installments and added to your mortgage payment.

For instance, a $250,000 loan with a 0.5% PMI rate would add about $1,250 per year—or roughly $104 per month—to your mortgage payment.

When Does PMI End?

The good news is PMI isn’t forever. Borrowers can stop paying PMI once they build sufficient equity in their home. Here are the common milestones:

- Automatic Termination: Federal law requires lenders to cancel PMI once the mortgage balance reaches 78% of the home’s original value (based on the purchase price).

- Borrower-Initiated Removal: You may request PMI cancellation once you reach 80% LTV, which can be accelerated by extra payments or rising home values.

- Refinance: Refinancing into a loan without PMI may be possible if your home’s value has appreciated significantly since purchase.

This is why keeping an eye on your loan balance and your home’s current market value is key. CapCenter clients often use our home value estimate tool to track progress toward canceling PMI.

PMI vs FHA Mortgage Insurance

Many first-time buyers confuse PMI with the mortgage insurance premiums (MIP) on FHA loans. Here’s the key difference:

- Conventional Loans: PMI can be canceled once enough equity is built.

- FHA Loans: Mortgage insurance is required on nearly all FHA loans, often for the life of the loan if you put down less than 10%.

For buyers who can qualify for a conventional loan, PMI is often the more flexible option since it can eventually go away.

Strategies to Avoid or Reduce PMI

While PMI makes low-down-payment loans possible, there are ways to avoid it or minimize the impact:

1. Put 20% Down

The most straightforward way to avoid PMI is to bring 20% down. For many, though, that’s easier said than done.

2. Use a Home Equity Loan “Piggyback” Strategy

Sometimes buyers use an 80/10/10 structure—an 80% first mortgage, a 10% second mortgage (home equity loan), and a 10% down payment. This avoids PMI, though it means managing two loans.

3. Consider Lender-Paid PMI (LPMI)

Some lenders offer to cover PMI in exchange for a slightly higher interest rate. While this eliminates the separate PMI payment, you may pay more over time.

4. Refinance at the Right Time

If your home appreciates or you’ve paid down your balance quickly, refinancing could eliminate PMI sooner.

CapCenter helps clients weigh these options. With our ZERO Closing Cost loans, refinancing becomes even more attractive since you won’t pay thousands in fees just to remove PMI.

The Real Cost of PMI Over Time

PMI’s impact can add up. Let’s look at a scenario:

- Loan: $300,000

- Down Payment: 5% ($15,000)

- PMI Rate: 0.6%

That’s $1,710 per year, or about $143 per month.

If it takes 7 years to reach 20% equity, you’ll have spent nearly $12,000 in PMI premiums. That’s money that doesn’t reduce your loan balance—it’s simply an added cost of accessing the loan.

This is why monitoring equity growth and refinancing opportunities is so important. At CapCenter, our advisors proactively help clients evaluate when refinancing makes sense—especially since our ZERO Closing Cost structure eliminates the usual barrier of paying upfront fees again.

How PMI Impacts First-Time Homebuyers

First-time buyers are the most likely to encounter PMI, since they often put less than 20% down. While some may feel discouraged by the extra cost, PMI should be viewed as a stepping stone rather than a permanent burden.

Without PMI, many buyers would be stuck renting for years while saving for a 20% down payment. By the time they saved enough, home prices may have risen, making ownership even less attainable.

PMI allows buyers to begin building equity sooner. Once canceled, homeowners can focus entirely on growing wealth through homeownership rather than paying insurance premiums.

PMI and Refinancing with CapCenter

For homeowners already paying PMI, refinancing can be a powerful solution—especially in today’s market, where home values in many areas have risen significantly.

Refinancing with CapCenter means:

- ZERO Closing Costs: You won’t pay the thousands of dollars in fees that other lenders charge.

- Equity Review: We’ll determine whether your home’s value supports eliminating PMI.

- Flexible Options: Whether you want to reduce your rate, shorten your term, or access equity, we’ll guide you through the best choice for your goals.

Our mortgage calculator can show you how refinancing could reduce your monthly payment by removing PMI.

FAQs About PMI

Is PMI tax-deductible?

PMI deductions have been phased in and out of tax law in recent years. It depends on current tax rules and your income. Always check with a tax advisor.

Does PMI protect me if I lose my job?

No. PMI protects the lender, not the borrower. For borrower protection, you’d need mortgage protection insurance or other financial safeguards.

Can I cancel PMI early?

Yes, if you’ve made extra payments or if your home’s value has increased significantly. A new appraisal may be required.

Do all loans require PMI?

No. VA loans, for example, do not require PMI. FHA loans have their own form of insurance.

Final Thoughts: Turning PMI Into a Short-Term Step

Private Mortgage Insurance can feel like an annoying extra cost, but it’s often the key to becoming a homeowner sooner rather than later. The important thing is knowing how it works, what triggers its removal, and how to plan your mortgage strategy with PMI in mind.

At CapCenter, we believe PMI should never feel like a lifelong burden. That’s why our team works with clients to monitor equity, explore refinance opportunities, and design a clear path to eliminate PMI while saving money along the way. And with our ZERO Closing Cost promise, you can refinance to drop PMI without worrying about thousands in fees.

If you’re paying PMI now—or wondering how it might affect your home purchase—contact CapCenter today to see how we can help you minimize costs and maximize your savings.